The most important information about bank codes at a glance

- Together with your account number, the bank code is the unique address of your bank account — just like the address of your home.

- Since 2014, you barely need the bank code anymore, because since then we have been using the IBAN as the address of bank accounts in Germany.

- However, it helps you to know your bank code, as it is part of the IBAN.

- In addition, bank codes reveal a few exciting details about the bank to which they belong.

What is a bank code and what do you need it for?

If someone wants to send you a letter, they need your postal address: your full name, your street and house number, the postal code and the city. Otherwise, the letter will not be received. If someone wants to send you money, the postal address won't help — they need the address of your bank account. And that's your account number and bank code.

The account number is like your street and house number: It describes which account within a bank the money should be credited to.

The bank code, on the other hand, is like the postal code with city: It reveals which bank your account is in. After all, there are plenty of banks in Germany and without a bank code, no one knows which bank you have your account with.

For this, every bank in Germany has its own bank code. All customers who have an account with this bank therefore have the same bank code. In Germany, it generally consists of 8 digits.

What do you need the bank code for?

You used to need the bank code when someone wanted to transfer money to you or when you signed a contract. Together with your account number, it was the unique “address” of your bank account.

Wait a minute, why “earlier”?

It's very simple:

Since 2014, the bank code has had its day: Now there is an IBAN

Today, it is very rare for anyone to ask you for your bank code. Because since February 1, 2014, in Germany and many other countries, we only use the IBAN together with the BIC. These are the international variants of account number and bank code. IBAN is an abbreviation and stands for International Bank AcCount NUmber.

Because there are now so many banking transactions that go beyond national borders that national account numbers and bank codes were simply impractical. Whenever someone wanted to transfer money abroad, that person had to search for IBAN and BIC first. This is no longer necessary because we now also use the IBAN for transfers within Germany. Almost everyone knows their IBAN and every transfer works the same way — whether to Germany, France, Italy or Poland.

But you shouldn't completely forget the bank code. Because it is part of the IBAN — so you still need it. Just not alone anymore.

Find out my bank code: Where can I find my bank code?

So if you want to know — or need to know — what your bank code is, here are a few ways you can find your bank code.

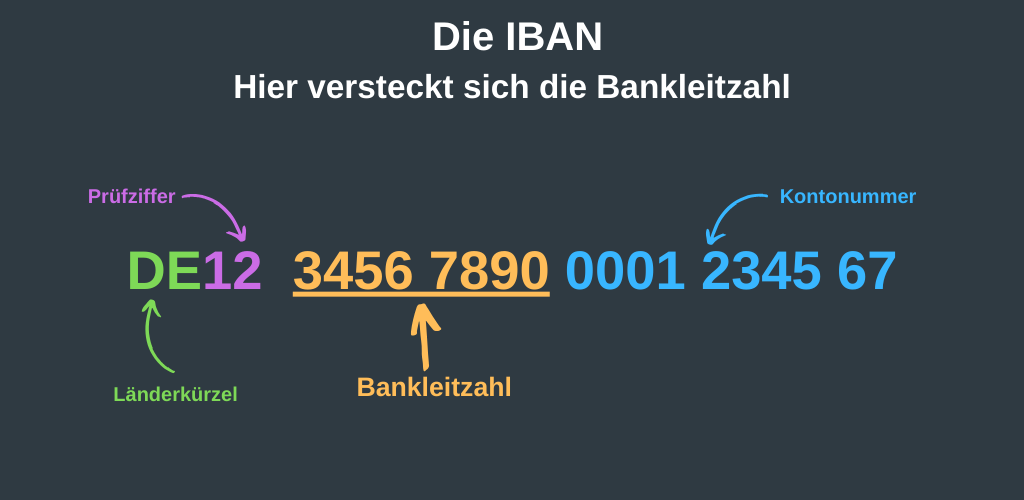

Read the bank code from the IBAN

Your bank code is hidden in your IBAN. If you know your IBAN, you can easily read what your bank code is. We'll show you how it works.

A German IBAN is always 22 digits long and is structured as follows:

The digits 1 + 2 are letters as abbreviations for the respective country. German IBANs always have a “DE” there.

The digits 3 + 4 are test rooms. They are there to make number twisters stand out more quickly in the IBAN so that the money certainly arrives where it needs to go.

The digits 5 to 13 are your eight-digit bank code.

The digits 14 to 22 are your account number. If your account number is shorter than 10 digits, the account number is at the end of the IBAN and the vacant digits between bank code and account number are filled with zeros.

How to find your bank code in online banking

If you do online banking, you can easily find out your bank code there. However, since every bank's online banking portal looks a bit different, we can't describe to you in general where it is hidden. In principle, however, the full IBAN should be displayed for every account in online banking — and you now know how to read the bank code from it.

How to find your bank code on your bank statement

If you don't do online banking, you'll probably get your account statements from an ATM using your bank card. You can also find your IBAN and BIC on every account statement — and now you know how to find the bank code in it. Some banks continue to print the bank code on the account statements — this makes it particularly easy for you.

Where is the bank code on the card?

If you can't access your online banking right now and ask yourself “Where can I find the bank code?” Is it also enough to take a look at your bank cardto find them. But where is the bank code on the card? Keep an eye out for the IBAN here too and filter out the bank code as described above.

Secret messages: That's what the bank code tells you

Attention, bragging! We will now tell you a few exciting details about bank codes that hardly anyone knows. Real bragging knowledge, in other words, to really impress at the next opportunity.

Did you know that you can tell which bank it belongs to and where that bank is based on the bank code?

The first four of the eight digits are important:

The first digit Tell you which region the bank is based in. They also speak of clearing-Area. Here you can see which number belongs to which area:

- 1: Berlin, Brandenburg, Mecklenburg-Western Pomerania

- 2: Bremen, Hamburg, Lower Saxony, Schleswig-Holstein

- 3: North Rhine-Westphalia (part of Rhineland)

- 4: North Rhine-Westphalia (parts of Westphalia and Lippe)

- 5: Hesse, Rhineland-Palatinate, Saarland

- 6: Baden-Wuerttemberg

- 7: Bavaria

- 8: Saxony, Saxony-Anhalt, Thuringia

The digits 2 and 3 Narrow down the area even further — but it would take far too long to show you all areas here.

Which bank belongs to which bank code?

It then gets exciting in the fourth place: It tells you which banking group the bank belongs to. You can see which number means what here:

- 0: Deutsche Bundesbank — as a private person, you usually have nothing to do with that.

- 1: Postbank and various other banks

- 2 and 3: different banks

- 4: Commerzbank and banks that belong to Commerzbank

- 5: This is the bank code of a savings bank or a state bank

- 6: Raiffeisen banks and cooperative central banks

- 7: This is a Deutsche Bank bank code

- 8: Commerzbank — Commerzbank exists twice, as it has taken over the former Dresden Bank and thus also its bank identification numbers

- 9: That is the bank code of a Volksbank

From a bank code, you can therefore tell exactly where the bank is based and which bank it is.

By the way: If you have an unknown bank code and want to know which bank it belongs to, Can you easily find out on the website of the Deutsche Bundesbank. Simply enter your bank code and you'll know which bank it belongs to. Conversely, you can also enter the name of the bank there and have the bank code displayed.

Transfer pocket money? Works even without a bank code!

Good news: If you want to transfer pocket money directly to your kids' account, you don't need a bank code or IBAN. Because when you use the Bling Card, you simply send the pocket money to your kids via the Bling app. There, by the way, you also keep control of spending, block certain expenses and save money together with your child on a new bike or the long-awaited game console.