What is parental allowance anyway?

We have lots of practical tips for you, which you can certainly use, especially with your first child. Because let's be honest: The whole topic of parental allowance and parental allowance calculator is a bit confusing. Who receives how long how much and under what conditions? Can you work on the side or does the parental allowance claim then expire? What do self-employed people actually get? Can they also calculate their parental allowance in advance? And which documents should you provide before the birth? You will get the answers to these and many other questions from us. Let's get started!

Let's first clarify a few terms relating to parental allowance and the parental allowance calculator, because that will certainly remove a lot of the confusion. You've probably read about both parental allowance and parental allowance or child-rearing allowance and asked yourself: What do I have to apply for now? It's easy: You apply for parental allowance. We use the term Parental allowance resp Child rearing allowance only synonymous, because this was, so to speak, the predecessor of parental allowance and is therefore commonly known. For all children born by the end of 2006, parents had to Parental allowance or apply for federal education allowance. Since the beginning of 2007, with the introduction of the Federal Parental Allowance and Parental Leave Act (BEEG), there has been Parental allowance. Parental leave is now also called parental leave. So much for the “technical terms.”

Now on to the matter itself and the parental allowance calculator/Parental allowance calculator: Parental allowance is a government benefit that is granted to parents for financial support during parental leave. It helps them to ensure their child's livelihood in the first months after birth, even without employment, which significantly facilitates the reconciliation of family and work. Parental allowance therefore compensates for the loss of income that parents have due to the reduction or temporary renunciation of their professional activity due to caring for their child. This enables parents to take time off from work and take intensive care of their newborn child. Because we know that the bond that a child builds with their parents in the first few months is extremely important — for both sides. So don't miss out on this government support. You can easily find the parental allowance application on the websites of the respective federal state, sometimes even digitally. We will list exactly which additional documents you need later. But now for the much more interesting question: How much is the parental allowance? You do not necessarily need a parental allowance calculator to calculate parental allowance. You can easily calculate a rough house number yourself. We'll show you what you should pay attention to when calculating parental allowance.

If you want

Use the parental allowance calculator: How much parental allowance do you get?

The exact amount of parental allowance and therefore also the Calculation of parental allowance depends on various factors, such as income before the child is born and the number of months in which parental allowance is received. However, you can roughly determine it in advance, even without a parental allowance calculator or parental allowance calculator. In principle, parental allowance is between 65% and 100% of the net income before the child is born, but there is also a minimum amount of €300 per month and a maximum of €1,800 per month. The graduation for calculating parental allowance is directly related to your income.

- If you earn between 1,000 and 1,200€ net, 67% parental allowance can be expected according to the parental allowance calculator.

- Earnings of €1,200 and €2,770 will gradually be reduced to 65%.

- Starting at €2,770, the maximum rate applies and, according to the parental allowance calculator, your entitlement to parental allowance is €1,800.

- Below 1,000€ net, the replacement rate rises to up to 100%, or up to the minimum amount of 300€ if you had no income in the twelve months before the birth.

For the calculation, for employees The average net income of the last twelve months before the birth of the child is used as the basis for the parental allowance calculator/parental allowance calculator. Parents can receive parental allowance for a period of 12 to 14 months, with two partner months being provided, which can only be received by the other parent. Single parents are entitled to the full 14 months.

Important: According to the parental allowance calculator/parental allowance calculator, net income includes only taxed earnings. Special benefits such as Christmas and vacation pay as well as other one-off payments or wage replacement benefits, such as sickness benefit, are not included in the calculation of parental allowance.

If you want

How much parental allowance is there for the self-employed?

For self-employed people Is the parental allowance calculator/parental allowance calculator fed with other information. For them, the parental allowance is based on the average monthly income from self-employment in the assessment period, which usually extends over the twelve calendar months preceding the month of birth of the child. The exact calculation method is a bit more complex here, as the parental allowance calculator takes into account various other factors in addition to income, such as expenses, depreciation and other tax aspects of self-employment. Important: Of course, it is absolutely clear to us that you have a lot on your mind during pregnancy. But anyone who cleverly calculates assignments here, i.e. really distributes them over the assessment period, is assured of a higher parental allowance according to the parental allowance calculator.

If you want

Special payments for siblings, twins & triplets

In some cases, there are also special payments in addition to parental allowance. This is how a Sibling bonus paid out provided that the older sibling is under three years of age or two siblings under six years of age live in the household. According to the parental allowance calculator/parental allowance calculator, this bonus accounts for 10% of parental allowance or at least 75€. For multiples, such as twins or triplets, there is also a supplement that should take into account the additional costs associated with caring for several children. The Multiple supplement amounts to €300 per month per child and is paid out independently of the sibling bonus. So there is no need for a parental allowance calculator here.

If you want

What does it mean Parental Allowance Plus?

In connection with the parental allowance calculator/Parental allowance calculator Does the term also appear again and again Parental Allowance Plus on. This is a variation of parental allowance, which allows you to work during the subscription period without this having a negative effect on the amount of parental allowance. Sounds complicated, but it's actually quite simple and is primarily intended for those who do not want to completely leave their job for several months so as not to lose touch, for example. Parental Allowance Plus therefore gives parents more flexibility when arranging parental leave and returning to work. It supports all parents who want to work part-time during parental leave. And it works like this: With Parental Allowance Plus, parental allowance is paid out on a part-time basis. Parents who opt for Parental Allowance Plus receive it over a longer period of time by working part-time and receiving parental allowance at the same time. Of course, the parental allowance calculator/parental allowance calculator also applies here and we would be happy to illustrate the difference to classic parental allowance with an example:

- Parental allowance: You apply for parental allowance for 12 months. Based on your previous earnings, this amounts to 1,100€ according to the parental allowance calculator/parental allowance calculator. You will now receive this on a monthly basis, earn nothing extra and can concentrate fully on your baby. In total, you will receive 13,200€. After 12 months, you will no longer receive payments and return to your job so that your monthly income is secured.

- Parental allowance plus: You apply for Parental Allowance Plus for two years, which means that your total claim of 13,200€ according to the Parental Allowance Calculator/Parental Allowance Calculator is divided over this period. As a result, you will of course have a smaller amount available each month. In addition, you work part-time, which compensates for the lower monthly Parental Allowance Plus. A classic return to work is not necessary in this way, because you were never really gone.

If both parents want to work part-time in parallel after the birth of the child in order to take care of the baby on an equal footing, the parental allowance calculator can also be used to provide an additional Partnership bonus be applied for. As a result, they secure Parental Allowance Plus for up to four more months and can both establish an intensive bond with their child to the same extent.

Important: Parents and single parents living separately from each other can also benefit from the partnership bonus.

If you want

Who is entitled to parental allowance/child-rearing allowance?

In principle, mothers and fathers are entitled to parental allowance. Of course, this includes not only biological parents, but also married and unmarried partners, provided that they live in a household with the child and care for the child together. Adoptive parents can also Apply for parental allowanceif they have welcomed the child into their household. In addition, there are a few other conditions that must be met in order to be eligible for parental allowance and to use the parental allowance calculator. This includes, for example,

- residence in Germany,

- caring for and raising the child in their own household, and

- compliance with income limits and minimum/maximum working hours when working part-time.

Attention: Please do not confuse parental allowance or parental allowance with child support! At child support is a monthly cash benefit that parents receive for each child to cover their basic needs and that Costs of raising children to support. Unlike parental allowance, child benefit is independent of income. Important: It is best to apply directly with your application for parental allowance. You will receive child benefit for children up to 18 years of age. For children who have reached the age of 18 but are still in education or studies, child benefit will continue to be paid up to the age of 25.

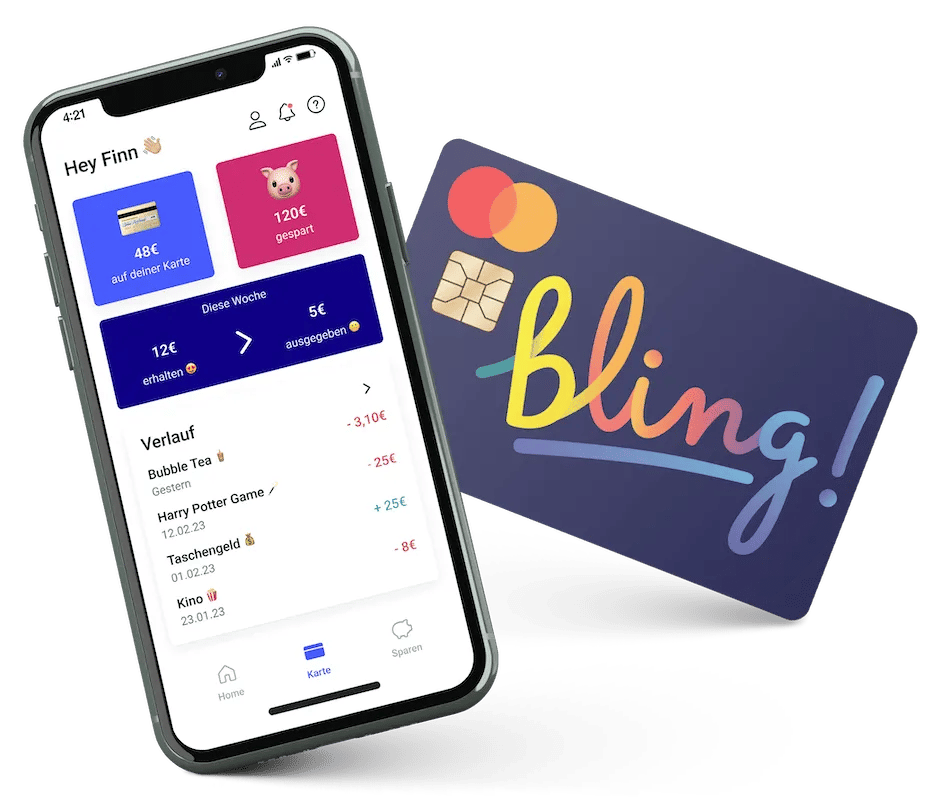

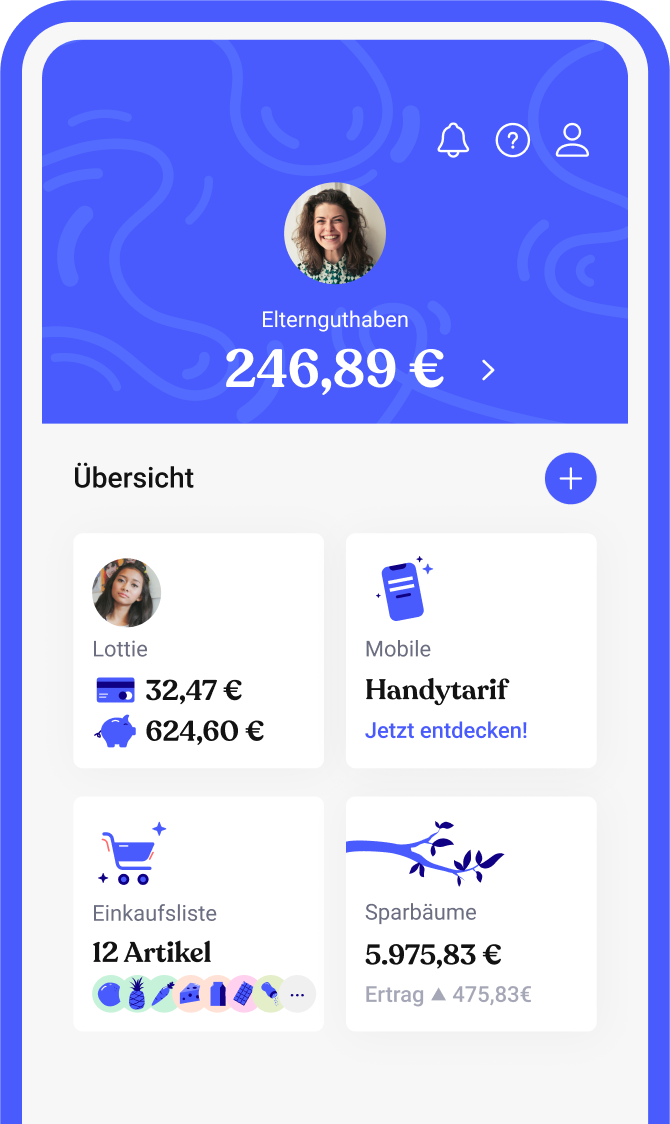

Our tip: At this time, for example if they already live in their own apartment, you can support your child with child benefit by simply having it paid out to your child. The right one for it Debit card for teens & kids With a clear app and numerous extras, we are happy to show you.

If you want

What documents do I need to apply for parental allowance?

- Application form:

Your master data and that of your partner are queried here. In addition, of course, you also indicate whether you would like to use Parental Allowance or Parental AllowPlus, or for which/how many months. With this information, the parental allowance calculator/parental allowance calculator can start its work.

- ID cards:

Both parents must identify themselves by making copies of their identity cards. - Income certificates:

We have already added the appropriate figures to the parental allowance calculator/parental allowance calculator earlier. The parental allowance office also needs this information, i.e. proof of income for the last twelve months before the birth or (in the case of shortly consecutive births) before the start of maternity leave. The best way to do this is to look up your payslips. Self-employed people prove their average monthly income over the last twelve months, for example by issuing invoices.

- Health insurance certificate:

The maternity allowance that you receive six weeks before to eight weeks (12 weeks in the case of multiple births) after the birth is offset against your parental allowance by the parental allowance calculator/parental allowance calculator. For this reason, you also need proof of these payments. You will usually receive this from your health insurance company without asking. If not, a quick phone call is probably enough.

- Certificate from the employer:

Since your employer pays a subsidy to your maternity allowance, this also requires appropriate proof for the parental allowance calculator/parental allowance calculator, similar to health insurance. Some employers have a special certificate for this, but proof of salary is usually sufficient. - Certificate of the calculated date of delivery:

In order to be able to determine the exact time entitlement to parental allowance, the parental allowance office requires proof of the expected date of delivery for the parental allowance calculator. Your midwife or gynaecologist will issue this to you. In the worst case scenario, this can also be used to calculate the premature months that you are entitled to in the event of a premature birth. - For planned part-time work:

Would you like to work part-time while receiving parental allowance? Then you must now specify how many hours that should be for the parental allowance calculator/parental allowance calculator. To do this, you need a certificate from your employer, which shows the number of hours and the gross salary. Self-employed persons also submit a profit forecast here.

- Sibling bonus for parental allowance:

If an older sibling already lives in your household, simply note this in the appropriate place in the application so that the parental allowance calculator/parental allowance calculator can take it into account. Of course, you will need his name and birthday as well as his file number. Further forms are usually not required for the sibling bonus. - Birth certificate:

After giving birth, you will receive various birth certificates from the registry office. One of them is for the parental allowance office. It says “for parental allowance” and must be submitted in the original with the application. Important: It is the only document that you do not have before the birth. So it really makes sense to prepare the application while you are pregnant, because as soon as the baby is there, you have no head for such things anymore. Then you are happy if all you have to do is add this one document and then bring the application to the mailbox. Attention: Finally, check everything again and don't forget the signature (s)!

Important: Parental allowance is paid retroactively for a maximum of three months. So submit your application in good time, preferably as soon as you have your child's birth certificate.

If you want

Is the parental allowance called family allowance in Bavaria?

No, that Family allowance In Bavaria, you will receive parental allowance and child benefit in addition. It is paid from the month of birth of the child until the end of the child's 36th month of life. In Bavaria, so to speak, there is something more. But what is family allowance? This is intended to financially support families with young children, regardless of whether they are employed or not. So you don't need a family allowance calculator here, as these are fixed amounts. However, this will Family allowance paid only for families that do not exceed certain income limits.

Our tip: If you live in Bavaria, you should apply for the Bavarian family allowance directly together with the parental allowance — you have already selected and compiled all the documents for this anyway. It is important to submit the application in good time, as family allowance, similar to parental allowance, can be granted retroactively from the month of birth of the child, but up to a maximum of three months before the month of application.

Another additional service is that State education allowance for example in Bavaria, which you should also apply for directly. It is granted by the individual federal states independently of parental allowance and can be claimed in addition to parental allowance. It is primarily aimed at parents who are not or only partially employed and care for their children at home. The exact regulations and conditions for state education allowance may differ from federal state to federal state and unfortunately it is also not paid out in all federal states. Therefore, it is best to find out about the respective state education allowance online, for example by googling “Landesziehungsgeld BW” or “Landesziehungsgeld Sachsen”.

If you want